Robert Prechter’s

The Socionomic Theory of Finance 2nd Edition

- Format: Book | Over 800 pages

$79

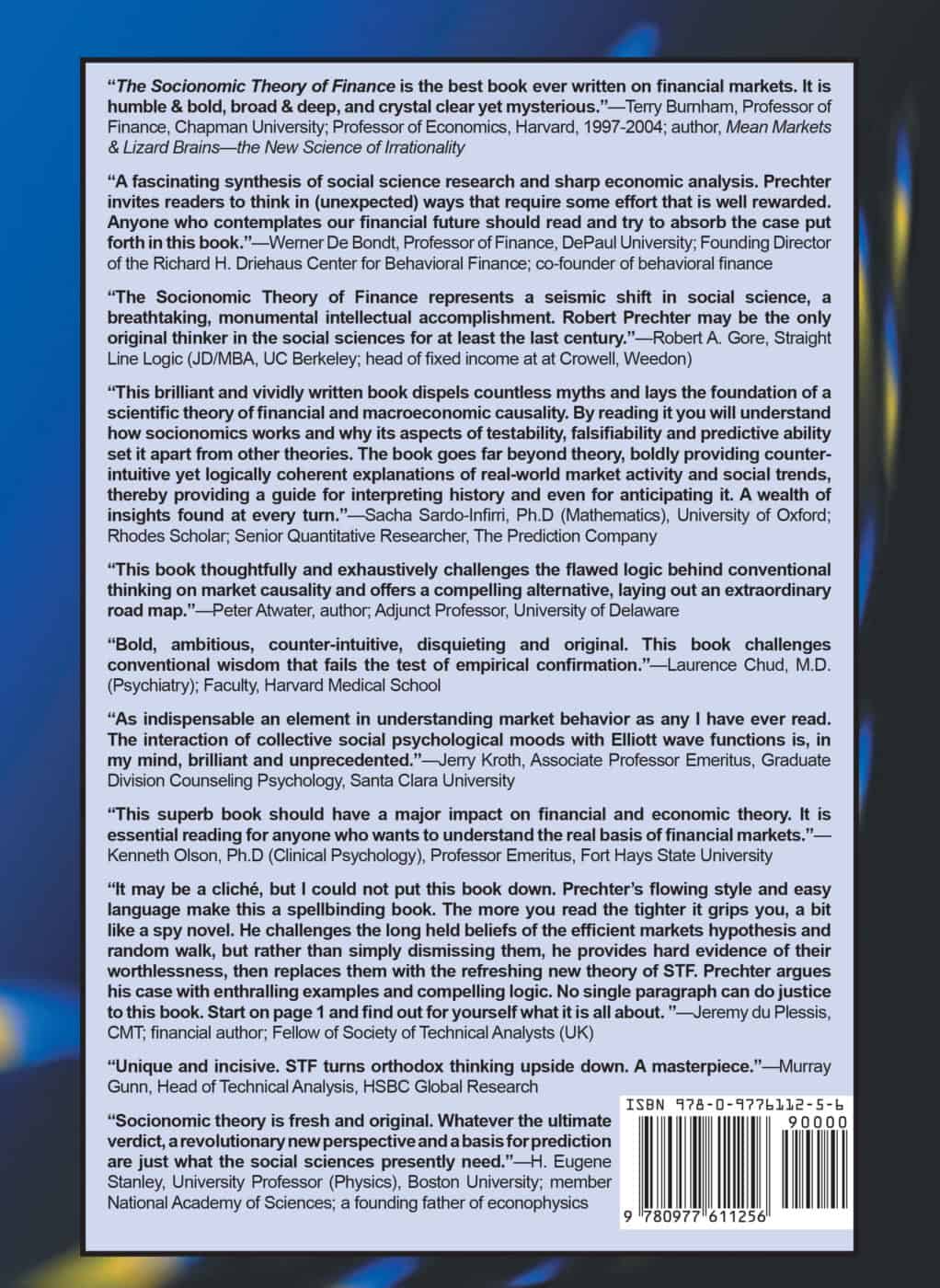

From the jacket:

The Socionomic Theory of Finance

The socionomic theory of finance (STF) proposes that economic and financial markets are fundamentally different from each other. The differences manifest at both the individual and aggregate levels and arise from the opposing contexts of relative certainty in the economic marketplace vs. pervasive uncertainty in the financial marketplace. In economic markets, producers and consumers, due to knowledge of their own values, consciously apply reason to decision making. This results in exogenously motivated objective pricing. In financial markets, speculators, due to ignorance of others’ future actions, unconsciously apply herding impulses to decision-making. This results in endogenously motivated subjective pricing.

The opposing motivations of producers and consumers cause economic markets to tend toward equilibrium, mean reversion and price stability, in a process regulated at the individual level by utility maximization and at the aggregate level by the laws of supply and demand. The unopposed motivations of speculators cause financial markets to tend toward dynamism in a process regulated at the individual level by spontaneous commands and at the aggregate level by the law of patterned herding. The pricing model for economic markets is the random walk. The pricing model for financial markets is a hierarchical fractal called the Wave Principle, described in the Elliott wave model. Neoclassical economic theory and, in finance, the efficient market hypothesis fail to discern all of these distinctions and inappropriately apply laws of economic causality to finance. STF is not a partial challenge to conventional formulations but rather is diametrically opposed to them in every major particular. STF aims to be both theoretically consistent and compatible with empirics.

Robert R. Prechter’s name is familiar to market observers the world over. Since founding EWI in 1979, Prechter has focused on applying and enhancing the Wave Principle, R.N. Elliott’s fractal model of financial pricing. Prechter shares his market insights in The Elliott Wave Theorist, one of the longest-running financial publications in existence today. Prechter has developed a theory of social causality called socionomics, whose main hypothesis is endogenously regulated waves of social mood prompt social actions. In other words, events don’t shape moods; moods shape events. Prechter has authored and edited several academic papers. He has written 18 books on finance and socionomics, including a New York Times bestseller.

The Socionomic Theory of Finance

2nd Edition

Waves of social mood affect every aspect of your life. They regulate the tone of politics, popular entertainment, the economy and the stock market. You can use these influences to your advantage. Society can’t do it, but an individual can. You will learn to read the news in a completely different way. You may even start predicting the news. This book will open a whole new world to you. It is exciting, intellectually fulfilling, fun and practical. Many readers say it changed their lives. Find out why.

$79

Hardback Book & eReader

Order by Phone

Mon-Fri, 8am-5pm Et

Contact us at 800-336-1618 or 770-536-0309 (Internationally) and you will get a fast, friendly, knowledgeable person to assist you.

LIVE CHAT

Mon-Fri, 8am-5pm ET

Please use the LIVE CHAT button at the bottom right of your screen to chat with us.